Find solutions with unique benefits to meet your retirement challenges

There are three important considerations to keep in mind when you’re building a retirement income strategy:

- Annuities

- Systematic Withdrawal Plans

- Guaranteed Lifetime Income Benefits

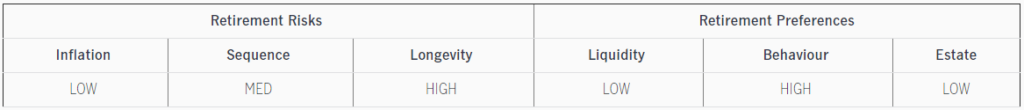

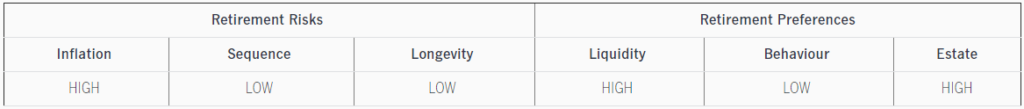

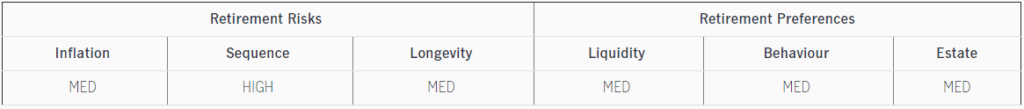

To determine what’s right for you, you’ll need to look at how each of the following could impact or influence how you want to invest.

Retirement risks:

- Inflation – The rising cost of goods and services could erode your savings

- Sequence of market returns – Poor market returns in the first few years of retirement could deplete your savings faster

- Longevity – Will you outlive your savings?

Retirement preferences:

- Liquidity – You may need access to your savings for unexpected expenses or emergencies

- Behavioural risk – Market volatility may cause you to make rash decisions that can undermine your financial plan

- Estate aspirations – The size of the inheritance you want to leave will impact the amount of money you can spend in retirement

Annuities, Systematic Withdrawal Plans and Guaranteed Lifetime Income Benefits offer unique features and benefits to meet each challenge so you can design a plan that works for you.

Annuities and other sources of guaranteed lifetime income, such as Defined Benefit Pension Plans, the Canada Pension Plan (CPP), and Old Age Security (OAS):

- Guaranteed income, typically for life

- Pre-determined regular income

- Market volatility protection

- Interest rate fluctuation protection

- Not liquid

- No control over how assets are invested

Systematic Withdrawal Plans (SWPs) linked to portfolios of mutual funds, stocks, bonds, GICs, cash, etc.

- Control over how assets are invested

- Flexible monthly income

- Growth potential to help keep up with inflation

- Income not guaranteed

Guaranteed Lifetime Income Benefits, including Guaranteed Minimum Withdrawal) Benefits (GMWBs)

- Guaranteed income possibly for life

- Growth potential to help income keep up with inflation

- Control over how assets are invested

- Predictable, sustainable and potentially increasing income

- Incur additional fee for guarantee

Based on your specific needs and preferences, I can help you determine how much of your money you should invest in each of these categories, taking into account the costs and the benefits of these products and how they interact with each other.

Courtesy of Manulife

Talk to me if you are ready to explore the options.

Arvin Jimenez

Life and Health Insurance Broker

604-626-8447 | arvin@arvinjimenez.com